What Is Skewness And Kurtosis In Finance. The main difference between skewness and kurtosis is that the former talks of the degree of. Skewness is a measure of symmetry in distribution whereas the kurtosis is the measure of heaviness or the density of distribution tails.

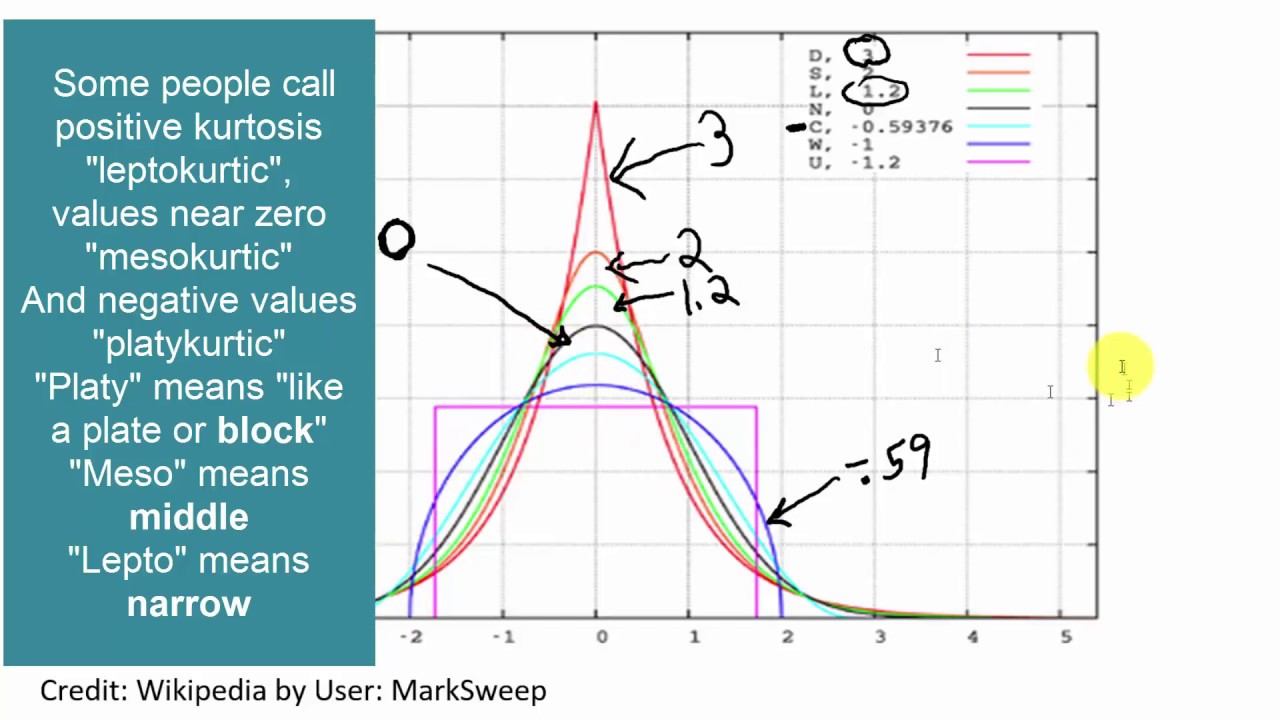

If the coefficient of kurtosis is larger than 3 then it means that the return distribution is inconsistent with the assumption of normality in other words large magnitude returns occur more frequently than a normal distribution. When calculating kurtosis a result of 300 indicates the absence of kurtosis distribution is mesokurtic. With the help of skewness one can identify the shape of the distribution of data.

Portfolio skewness s P w M 3 w w and portfolio kurtosis k.

With the help of skewness one can identify the shape of the distribution of data. A given distribution can be either be skewed to the left or the right. Kurtosis is useful in statistics for making inferences for example as to financial risks in an investment. With the help of skewness one can identify the shape of the distribution of data.